Saving money each month can be hard. With rising costs and unpredictable expenses, many struggle to keep finances in control.

But with the right strategies, you can build strong saving habits. This article will guide you step-by-step through realistic ways to save more every month.

If you’re ready to take control of your money and improve your financial future, read on for practical, proven tips.

Track All Monthly Expenses

To save money monthly, you need to know where it’s going. Start by tracking all your expenses. Use budgeting apps like to categorize your spending.

Break your expenses into needs and wants. Essentials like rent and groceries are non-negotiable, but subscriptions and dining out can often be cut.

Understanding your spending habits is the first key step toward better financial management.

Set Realistic Budget Goals

Budgeting is your financial roadmap. It tells your money where to go instead of wondering where it went.

Create a monthly budget that includes fixed expenses, variable costs, and savings goals. Be realistic. If your budget is too strict, you may abandon it.

Allocate funds for emergencies and unexpected needs. This prepares you for surprises without derailing your savings plan.

Use the 50/30/20 Rule

This simple method helps balance your spending:

-

50% for needs (bills, groceries, rent)

-

30% for wants (entertainment, hobbies)

-

20% for savings and debt repayment

It’s flexible and easy to follow. Adjust the percentages based on your income level or goals, but always aim to save that 20%.

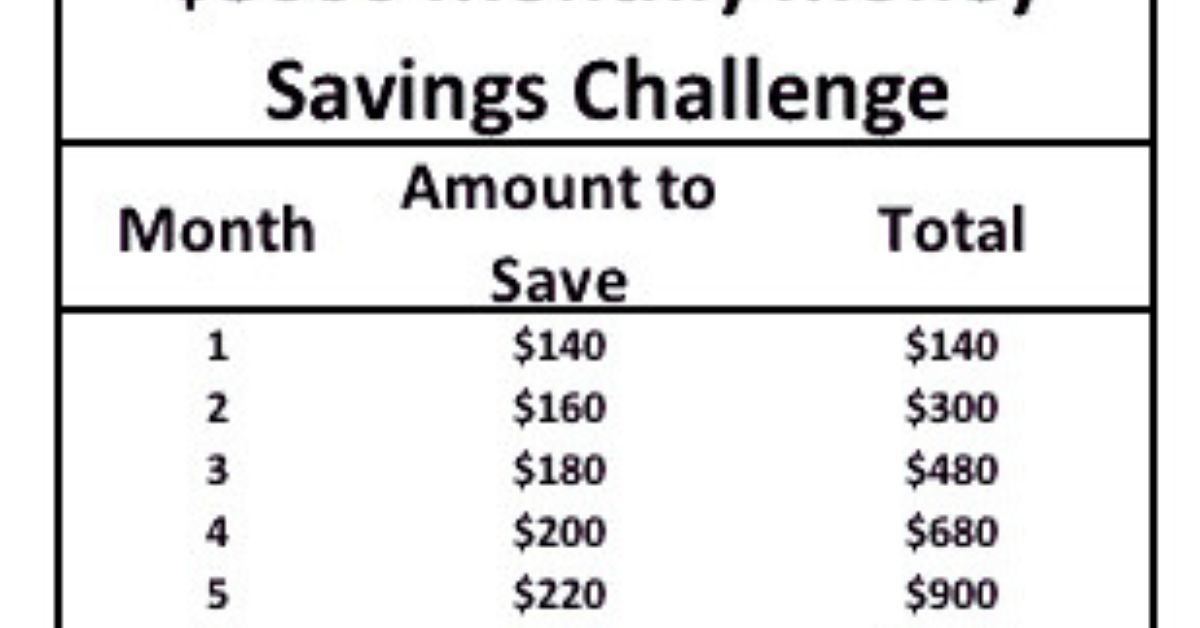

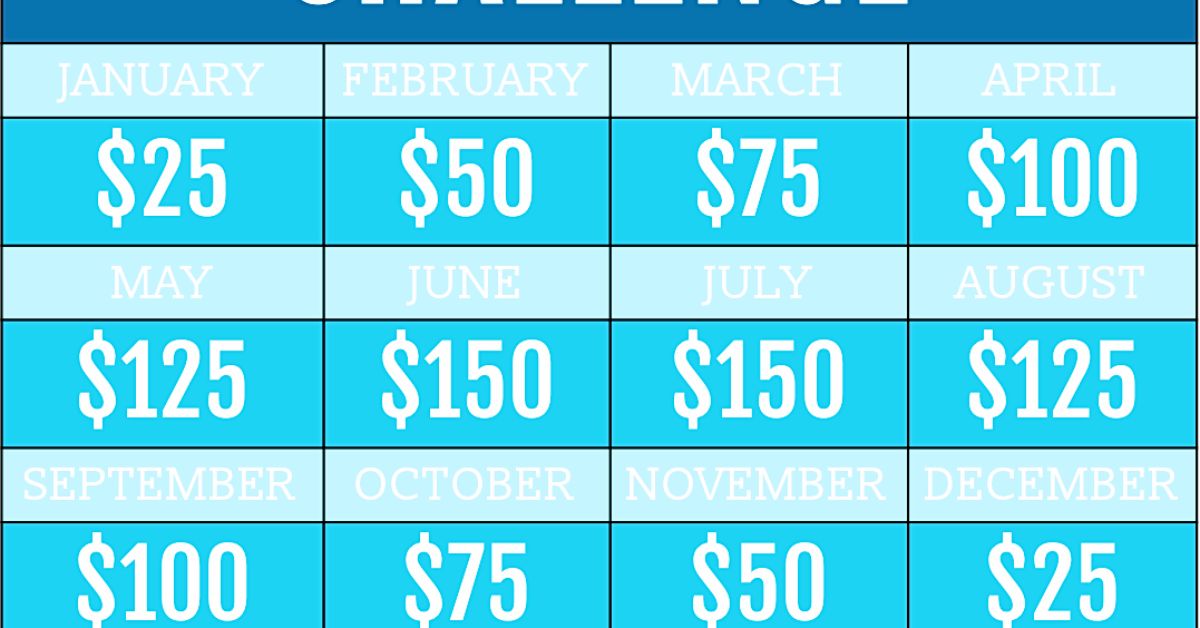

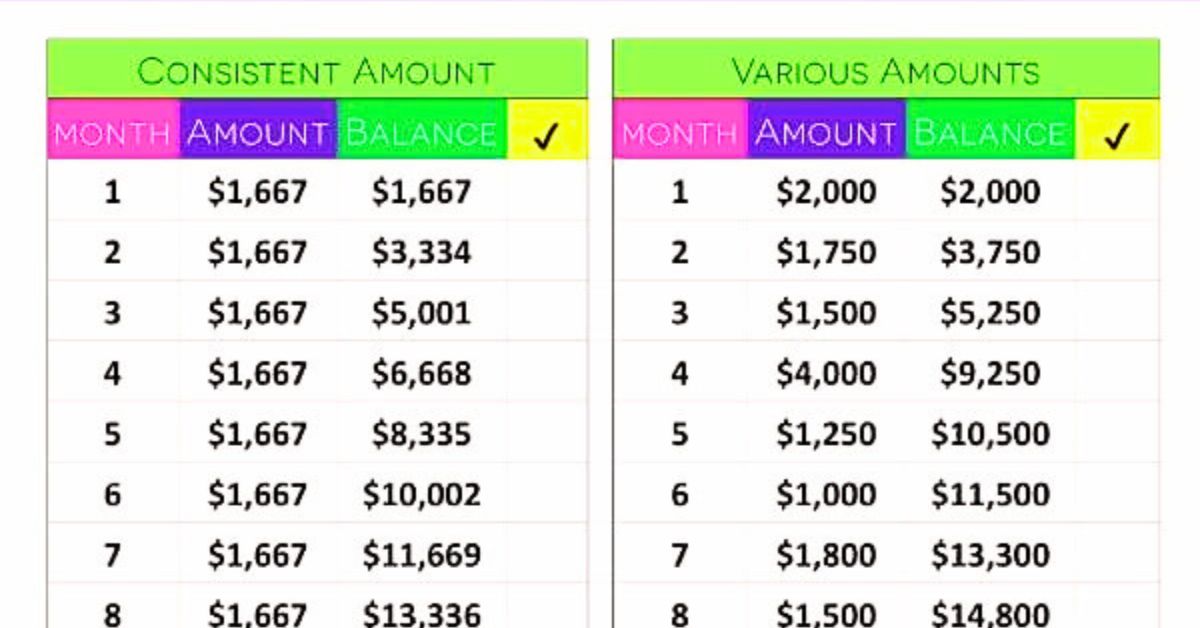

Automate Your Savings Plan

Don’t wait until the end of the month to save what’s left. Pay yourself first.

Set up automatic transfers from your checking to savings account every payday. Even a small amount adds up over time.

Automation removes temptation and helps make saving a consistent habit.

Cut Unnecessary Subscriptions

Monthly subscriptions can silently drain your budget. Review your streaming services, app charges, and memberships.

Cancel anything you don’t use regularly. Tools like help you identify and manage recurring charges easily.

That $10/month you forgot about could become $120 saved per year.

Cook at Home More Often

Dining out is a major budget buster. Even casual meals can cost 3–5 times more than home-cooked alternatives.

Plan weekly meals, buy groceries in bulk, and prep food in advance. You’ll eat healthier and save hundreds each month.

Use apps like Mealime or Paprika to make meal planning fun and stress-free.

Use Cash or Debit Only

Credit cards encourage overspending. Switch to using cash or a debit card to make purchases feel more real.

Studies show people spend less when they use cash. Try the envelope method: assign cash for different categories like groceries or entertainment, and stop spending when it’s gone.

This builds discipline and improves awareness of your financial limits.

Shop Smarter and Save Big

Always compare prices before buying. Use tools like Honey or Rakuten for coupons and cashback.

Buy in bulk for items you frequently use. Stick to a list when grocery shopping to avoid impulse buys.

Shop sales, use reward points, and avoid emotional spending. Smart shopping adds up quickly.

Reduce Utility Bills

Lowering your energy and water usage saves money every single month.

Use energy-efficient appliances. Turn off lights when not in use. Unplug devices that draw power even when idle.

Set thermostats a few degrees lower in winter and higher in summer. Use fans and natural light when possible.

Small changes can reduce your bill by 10–30%.

How to Save Money Monthly

Now that you know practical strategies, let’s tie them together into a repeatable monthly system.

1. Review Last Month’s Spending

Look at what worked and what didn’t. Adjust your goals based on any unexpected costs or income changes.

2. Set Your Budget and Goals

Plan where each dollar goes. Include savings goals and emergency funds.

3. Automate and Track Progress

Use tools to automate savings and monitor how well you stick to your plan.

4. Celebrate Small Wins

Saved an extra $50? That’s a win. Keep motivated by tracking progress and rewarding yourself within budget.

Avoid These Common Mistakes

-

No emergency fund: Even $500 can prevent credit card use in a crisis.

-

Unrealistic goals: Start small. Saving $20/week is better than nothing.

-

Impulse shopping: Wait 24 hours before buying non-essentials.

-

Ignoring debt: Pay off high-interest debt before saving aggressively.

Build Better Financial Habits

Saving money monthly is more about behavior than income. Create habits like:

-

Reviewing accounts weekly

-

Planning meals and errands

-

Tracking financial goals

-

Saying no to peer pressure spending

These habits become automatic over time and help secure your financial future.

Conclusion

Learning how to save money monthly can change your life. It puts you in control, reduces stress, and helps you plan for the future.

You don’t need to make big changes overnight. Start with one or two tips from this article. Build momentum over time.

The earlier you begin, the more you benefit from compounding growth and financial peace.

External links

-

Consumer Financial Protection Bureau – Free tools and advice on saving and budgeting.

-

NerdWallet – Personal finance guides and savings calculators.

-

Investopedia – Explains financial terms and saving strategies in simple language.