Planning for retirement can feel overwhelming. Many people worry they won’t have enough money to retire comfortably. The fear of outliving savings or relying solely on social security is very real.

This retirement planning guide aims to simplify the process. We’ll walk you through everything from setting goals to choosing the right investment tools.

By the end of this guide, you’ll feel more confident about your future. Let’s dive in and help you build the retirement of your dreams.

Why Retirement Planning Matters

Planning early helps avoid financial stress later in life. It ensures you can maintain your lifestyle after leaving work. With life expectancy rising, you might need income for 20-30 years post-retirement.

Set Retirement Goals Early

The first step is setting clear goals. Know when you want to retire and what kind of lifestyle you expect. This helps estimate your total savings target.

Calculate Future Expenses

Estimate monthly expenses including housing, healthcare, travel, and entertainment. Don’t forget inflation. Use online retirement calculators to get an accurate picture.

Start Saving as Soon as Possible

The earlier you start, the more time your money has to grow. Compound interest is powerful. Even small amounts add up over decades.

Use Retirement Savings Accounts

Maximize tax-advantaged accounts:

- 401(k): Offered by employers, often with matching contributions.

- IRA: Great for individual retirement savings.

- Roth IRA: Provides tax-free income in retirement.

Diversify Investment Portfolio

Don’t put all your eggs in one basket. Spread investments across stocks, bonds, mutual funds, and ETFs. Adjust risk level as you age.

Monitor and Adjust Plan

Review your plan annually. Adjust contributions, goals, or investments based on life changes like marriage, kids, or income shifts.

Understand Social Security Benefits

Know how and when to claim Social Security. Benefits increase the longer you wait (up to age 70). Use SSA.gov to estimate your benefit.

Consider Healthcare Costs

Healthcare can be a major expense. Plan for insurance, prescriptions, and unexpected costs. Learn about Medicare eligibility and coverage.

Explore Retirement Income Streams

Beyond savings, consider:

- Pensions

- Annuities

- Rental income

- Part-time work

Multiple income sources provide stability.

Work With a Financial Advisor

A certified planner can help personalize your strategy. They provide insights, manage investments, and keep your goals on track.

Create a Withdrawal Strategy

Know how much to withdraw yearly. Follow the 4% rule or adjust based on market performance. Avoid withdrawing too fast.

Plan for Taxes in Retirement

Understand how withdrawals, Social Security, and pensions affect taxes. Tax planning helps keep more of your money.

Estate Planning Is Essential

Create a will, assign power of attorney, and name beneficiaries. This ensures your assets are distributed as you wish.

Avoid Common Retirement Mistakes

Don’t:

- Start too late

- Underestimate healthcare costs

- Withdraw savings too early

- Forget inflation

Stay informed and flexible.

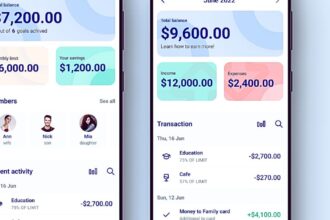

Use Tools and Resources

Helpful websites include:

Track Your Progress Regularly

Check your retirement account statements. Review net worth and adjust plans based on performance. Stay committed to your goals.

Retirement Planning Guide Recap

In this retirement planning guide, we covered:

- Setting goals

- Saving early

- Investing smartly

- Managing taxes and healthcare

Follow these steps to build a secure and enjoyable retirement.

Conclusion

Retirement planning doesn’t have to be hard. Start with small steps. Stay consistent. Your future self will thank you.

Consult experts, use online tools, and stay informed. The earlier you begin, the brighter your golden years will be.