When considering financing options for a vehicle, two primary choices emerge: a car loan and a personal loan. Understanding the distinctions between these options is crucial to making an informed decision that aligns with your financial situation and goals.

Purpose of the Loan

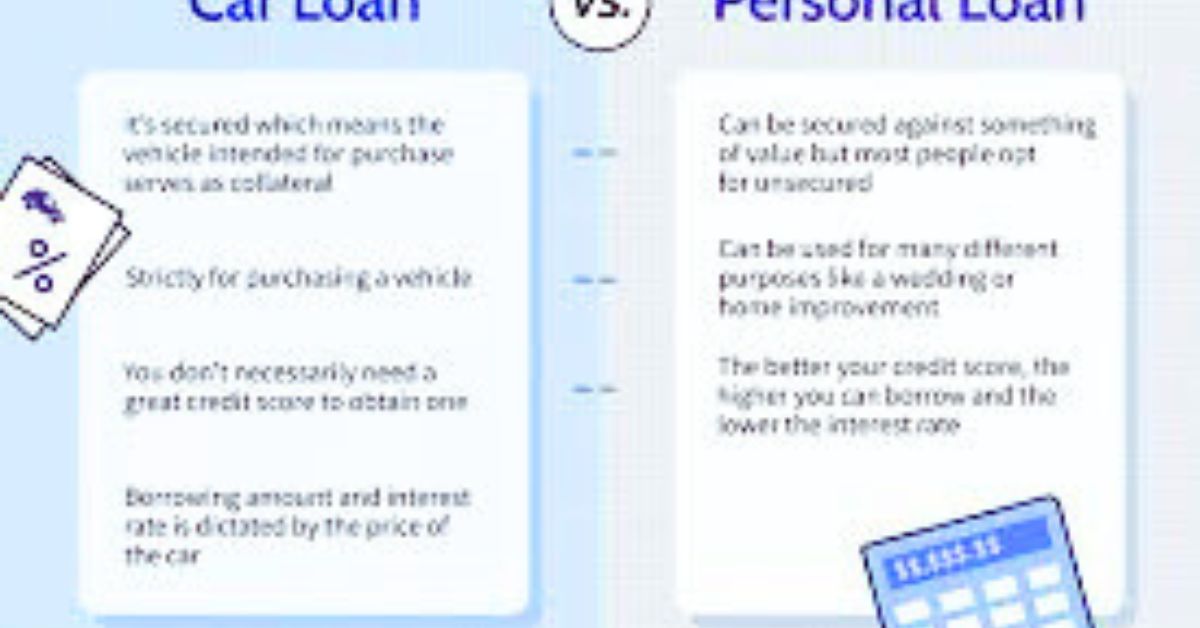

A car loan is specifically designed for purchasing a vehicle, with the car itself serving as collateral. This means that if you default on the loan, the lender has the right to repossess the vehicle. In contrast, a personal loan offers greater flexibility, allowing you to use the funds for various purposes, including buying a car, consolidating debt, or covering unexpected expenses.

Interest Rates and Terms

Car loans typically offer lower interest rates compared to personal loans, as they are secured by the vehicle. Interest rates for car loans generally range from 4.75% to 20.62%, depending on factors like credit score and loan term. Personal loans, being unsecured, often come with higher interest rates, ranging from 6% to 36%.

The repayment terms for car loans usually span from 24 to 72 months, while personal loans offer terms ranging from 12 to 84 months. Longer terms can result in lower monthly payments but may increase the total interest paid over the life of the loan.

Down Payments and Collateral

Car loans often require a down payment, typically around 20% for new cars and 10% for used vehicles. This upfront payment reduces the loan amount and demonstrates the borrower’s commitment. Personal loans, on the other hand, usually do not require a down payment, providing immediate access to the full loan amount.

Since car loans are secured by the vehicle, the lender holds the title until the loan is repaid in full. Failure to make payments can lead to repossession of the car. Personal loans are typically unsecured, meaning they don’t require collateral, but defaulting can still negatively impact your credit score and lead to legal actions.

Eligibility and Approval

Obtaining a car loan may be more straightforward, especially if you have a stable income and a decent credit score. Lenders often consider the value of the vehicle and your ability to repay the loan. Personal loans may have stricter eligibility criteria, including a higher credit score and a lower debt-to-income ratio, due to the lack of collateral.

Pros and Cons

Car Loan:

-

Pros: Lower interest rates, longer repayment terms, and potential tax benefits in some regions.

-

Cons: Requires a down payment, limits purchasing options to vehicles that meet lender criteria, and carries the risk of repossession.

-

Personal Loan:

-

Pros: No down payment required, flexible use of funds, and no collateral needed.

-

Cons: Higher interest rates, shorter repayment terms, and potentially stricter eligibility requirements.

Making the Right Choice

The decision between a car loan and a personal loan depends on your financial situation, creditworthiness, and specific needs. If you have a stable income, a good credit score, and prefer lower interest rates, a car loan may be the better option. However, if you value flexibility and have the financial discipline to manage higher interest rates, a personal loan could suit your needs.

External Links: