Managing family finances can feel overwhelming.

From groceries to school fees, expenses quickly add up. Without a clear plan, it’s easy to lose track of spending. Financial stress can impact both relationships and future goals.

Thankfully, budgeting apps for families are changing the game. These tools help households manage money together. They make it simple to track expenses, set goals, and save.

In this guide, we’ll explore the best family budgeting apps. You’ll find tools that work for all household sizes. Let’s dive in and find the right one for your family’s needs.

Why Families Need Budgeting

Family life involves shared expenses.

From rent and bills to family outings, tracking these costs is essential. Budgeting prevents overspending and helps prioritize savings.

When every family member knows the budget, financial transparency improves. This builds trust and creates shared responsibility.

Features to Look For

Not all apps offer the same tools.

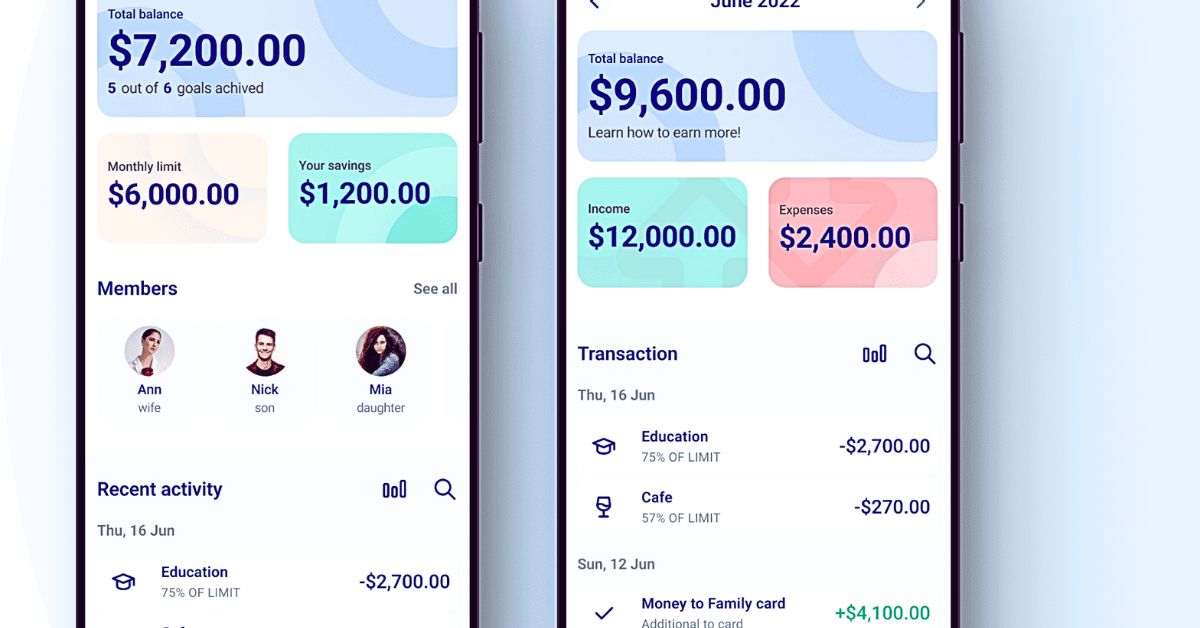

Look for shared accounts, spending alerts, and goal tracking. Some apps support multiple users and real-time syncing.

Make sure the app fits your family’s size and financial goals. Also, check for data security and bank integration features.

Best Budgeting Apps in 2025

1. YNAB (You Need A Budget)

YNAB promotes zero-based budgeting.

This means every dollar has a job. It helps families assign funds to all expenses, including savings. The app includes syncing across devices and support for multiple users.

Key Features:

- Real-time tracking

- Debt paydown tools

- Goal setting

Best For: Families that want full control and financial discipline.

2. EveryDollar

Developed by Ramsey Solutions.

EveryDollar is simple and user-friendly. It follows the zero-based method. The app works best for families new to budgeting.

Key Features:

- Drag-and-drop interface

- Expense tracking

- Goal-oriented plans

Best For: Beginners and simple family budgets

Website: EveryDollar

3. Goodbudget

Great for envelope-style budgeting.

Goodbudget divides income into virtual envelopes. It encourages families to plan monthly spending by category. It supports multiple devices and members.

Key Features:

- Cloud syncing

- Envelope budgeting

- Manual entry and automation

Best For: Families who prefer planning over tracking

4. Honeydue

Designed for couples and small families.

Honeydue lets partners see shared and individual expenses. It also sends bill reminders and supports multiple bank accounts.

Key Features:

- Expense categorization

- Custom notifications

- Secure bank syncing

Best For: Couples managing finances together

5. PocketGuard

Simplifies spending visibility.

PocketGuard shows how much money is left “in your pocket” after essentials. It’s great for families wanting a clear daily view.

Key Features:

- Automatic syncing

- Custom spending limits

- AI insights

Best For: Busy families needing automation

Benefits of Using These Apps

Improves Financial Communication

Budgeting apps foster open discussions about money. Everyone can see the budget and contribute to decisions.

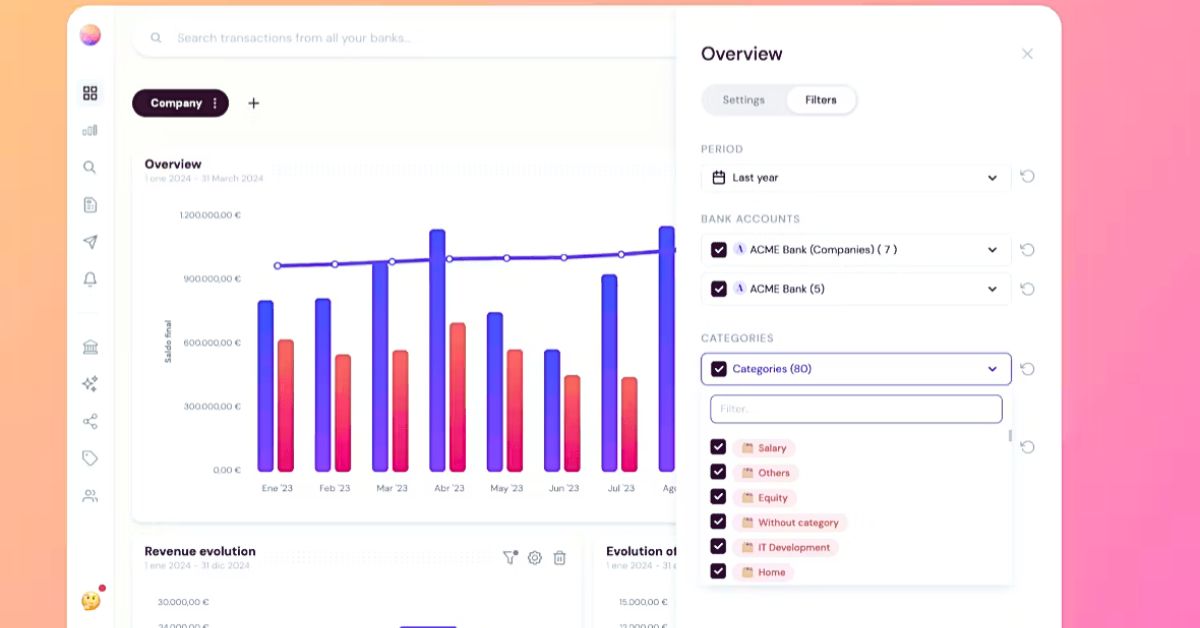

Tracks Spending Easily

Apps provide real-time tracking and visual reports. These tools help identify spending patterns and cut unnecessary costs.

Encourages Saving Together

Set family savings goals, such as for vacations or emergency funds. Watching progress motivates consistent saving.

Prevents Financial Surprises

Automatic alerts warn of overspending or bills due soon. These reminders help avoid late fees and financial strain.

How to Choose the Right App

Consider Your Budget Style

Do you want automation or manual control? Choose an app that matches your preferred style.

Check Family Compatibility

Ensure all family members can use the app. Look for multi-user access and intuitive interfaces.

Review Security Features

Financial apps must protect your data. Choose tools with encryption and trusted bank-level security.

Compare Costs and Plans

Many apps offer free versions, but features vary. Premium plans may be worth the investment for families.

Tips for Family Budgeting Success

Set Clear Financial Goals

Start with shared goals. Saving for school, vacations, or emergencies gives purpose to your budget.

Hold Monthly Budget Meetings

Regular check-ins help keep everyone aligned. Review expenses, goals, and adjust plans as needed.

Involve the Whole Family

Teach kids about budgeting early. Use apps with visuals and simple breakdowns to include them in planning.

Stay Consistent

Budgeting only works when it’s ongoing. Make it part of your routine.

Real-Life Examples

The Johnson Family’s Story

After using YNAB, they paid off $10,000 in debt. They now save monthly and teach their kids money skills.

A Single Parent’s Approach

Sarah uses EveryDollar to manage bills, school costs, and meals. It helps her track everything on one screen.

Newlyweds with Shared Goals

With Honeydue, Mike and Priya synced their accounts. It made joint decisions smoother and reduced misunderstandings.

Conclusion

Budgeting apps for families make money management simpler. Whether you’re a couple, parent, or multi-generational household, there’s a tool for you.

Pick an app that matches your needs, commit to regular use, and involve the whole family. You’ll reduce stress, improve savings, and build a stronger financial future together.

External Links:

- Consumer Financial Protection Bureau

- NerdWallet Budget App Reviews

-

Investopedia on Budgeting