Unexpected expenses can disrupt your entire budget. Medical bills, job loss, or urgent repairs often come without warning. These moments can put a serious strain on your finances.

That’s where an emergency fund comes in. It’s a financial cushion designed to help you stay afloat during tough times. With a strong emergency fund, you won’t need to rely on high-interest loans or credit cards.

In this guide, you’ll learn why an emergency fund is essential, how to build one, and tips to make it work. Keep reading to secure your financial future.

What Is an Emergency Fund?

An emergency fund is money set aside to cover unforeseen expenses. These can include:

- Job loss

- Medical emergencies

- Home or car repairs

- Unexpected travel

This fund acts as a financial safety net. It helps avoid debt and keeps your long-term goals on track. According to Investopedia, financial experts recommend saving at least 3–6 months’ worth of expenses.

Why Emergency Funds Matter

An emergency fund gives peace of mind. Life is unpredictable. Having cash reserved allows you to face sudden costs without panic. Here’s why it’s crucial:

- Avoids high-interest debt

- Prevents stress and anxiety

- Helps maintain your lifestyle

- Keeps investment plans intact

Without one, you may fall back on credit cards or loans, which only worsen your financial situation.

How Much You Should Save

Start small if needed. Even $500 can handle minor emergencies. Then aim higher:

- Single with no dependents: 3 months of expenses

- Family with kids: 6 months or more

- Freelancers or business owners: up to 12 months

Calculate your essential monthly costs: rent, food, utilities, and insurance. Use that figure to set your savings goal.

Where To Keep Your Funds

Keep your emergency money accessible but separate from daily spending. Ideal options include:

- High-yield savings accounts

- Money market accounts

- Online banks with no fees

Avoid investing these funds in stocks. Liquidity and security matter more than returns. NerdWallet suggests using a dedicated savings account to avoid temptation.

Building Your Emergency Fund

Start by tracking expenses. Then cut non-essentials to save faster. Here are practical tips:

- Set up automatic transfers

- Save windfalls like tax refunds

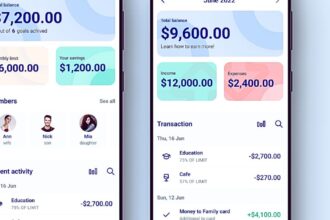

- Use budgeting apps for tracking

Building a fund takes time, but consistency pays off. Even small amounts grow with regular saving.

Emergency Fund vs. Savings

Regular savings might fund vacations or big purchases. An emergency fund is strictly for urgent, unavoidable costs.

Key differences:

- Purpose: emergencies only

- Access: quick but limited

- Location: separate from general savings

This distinction helps avoid dipping into your emergency money for non-urgent wants.

Common Emergency Examples

People often underestimate what counts as an emergency. Real-life scenarios include:

- Job layoffs

- Broken appliances

- Pet emergencies

- Medical bills not covered by insurance

Planning ahead helps you act fast without delay or panic. The Balance explains how emergency funds prevent debt spiral in these situations.

Mistakes To Avoid

Many skip building an emergency fund or use it improperly. Common mistakes include:

- Mixing funds with checking accounts

- Using credit cards instead

- Saving too little or too slowly

- Spending it on non-emergencies

Stay disciplined. Label your fund and don’t touch it unless absolutely necessary.

How It Supports Mental Health

Money stress can affect your emotional well-being. A safety net reduces anxiety and improves sleep.

Knowing you’re prepared for the unexpected provides calm and confidence. This benefit is just as valuable as financial security.

Emergency Fund Importance in 2025

In 2025, inflation and job market shifts increase financial risks. Having a well-built fund is more important than ever.

- Layoffs are rising in tech and retail.

- Medical costs continue to grow.

- Home repairs are pricier due to supply chain issues.

Preparation today means less hardship tomorrow.

Tips For Staying Motivated

Saving money isn’t always exciting. Use these tricks to keep going:

- Set visual goals

- Celebrate milestones

- Join online savings challenges

- Share goals with friends for accountability

Staying focused on your “why” helps turn saving into a habit.

Tools To Help You Save

Use technology to your advantage. Helpful tools include:

- Budgeting apps like YNAB or Mint

- Savings automation tools

- Online calculators to set goals

These tools simplify the process and make tracking progress easier.

When To Use Your Fund

Only tap your emergency savings when it’s truly necessary:

- Urgent medical care

- Job loss with no income

- Essential car repair for work commute

Ask: “Is this unexpected, urgent, and necessary?” If not, reconsider using the fund.

Rebuilding After Use

Don’t panic if you deplete your fund. Rebuild it using the same strategies:

- Resume auto-savings

- Cut extra expenses temporarily

- Look for side income or gig work

Quick recovery protects you from future crises.

Conclusion:

Emergencies happen to everyone. The best defense is preparation. By building an emergency fund, you protect your health, your peace of mind, and your future.

Start saving today. Even small steps lead to big safety. Because when life throws a curveball, you’ll be ready—not sorry.

External Sources: