Managing money is tough for many people. Unexpected expenses, poor planning, and rising costs often cause stress and financial strain.

The solution lies in learning key money management skills. These skills help you track spending, create a budget, and build long-term wealth.

If you want financial freedom, keep reading. This guide will show you how to master the basics and beyond.

Why Financial Literacy Matters

Many people lack financial education. This leads to debt, poor credit, and little to no savings.

Financial literacy empowers you. It helps you make informed decisions, avoid debt traps, and plan for your future.

Schools rarely teach personal finance. That’s why self-learning and articles like this are so valuable.

Set Clear Financial Goals

Setting goals gives your money direction. You need both short- and long-term goals to stay motivated.

Short-term goals might include paying off a credit card or building an emergency fund.

Long-term goals could be buying a home, retiring comfortably, or funding a child’s education.

Use the SMART method: Specific, Measurable, Achievable, Relevant, Time-bound.

Build a Realistic Budget

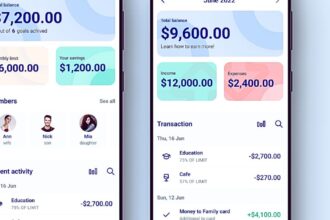

A budget is your financial roadmap. It shows income vs. expenses.

Start by tracking every expense. Categorize your spending and identify areas to cut.

Use the 50/30/20 rule: 50% needs, 30% wants, 20% savings and debt payments.

Apps like Mint or YNAB can help manage your budget easily.

Track Your Spending Habits

Without tracking, spending becomes guesswork.

Write down or record every transaction. Review it weekly or monthly.

Look for unnecessary expenses. Cancel unused subscriptions or limit dining out.

Tracking helps you stay in control and avoid overspending.

Emergency Funds Are Essential

An emergency fund is your safety net.

Aim for 3 to 6 months of living expenses.

Keep the money in a high-yield savings account for easy access and growth.

This fund protects you from job loss, medical bills, or urgent repairs.

Use Credit Responsibly

Credit isn’t bad—irresponsible use is.

Pay your credit card balance in full each month.

Avoid maxing out your cards. Keep credit utilization under 30%.

Check your credit report yearly and dispute errors.

Good credit scores lead to lower interest rates and better loan approvals.

Learn Basic Investing Skills

Investing builds long-term wealth.

Start with low-risk options like index funds or retirement accounts.

Understand risk tolerance and diversify your investments.

Use robo-advisors or consult a certified financial planner if needed.

Manage Debt Effectively

Debt isn’t always bad. But too much can be harmful.

List your debts from highest to lowest interest rate.

Use either the avalanche or snowball method to pay them off.

Avoid taking new debt unless necessary and affordable.

Practice Smart Saving Habits

Saving money should be automatic.

Set up direct deposits to your savings account.

Save for specific goals like vacations, holidays, or large purchases.

Look for discounts, cashback offers, and loyalty programs.

Increase Your Income Streams

More income means more savings and faster debt repayment.

Consider freelance work, side businesses, or gig economy jobs.

Upskill through online courses to qualify for better-paying roles.

Passive income ideas include investing in real estate or dividend stocks.

Teach Kids About Money

Financial habits start young.

Use chores or allowance to teach value of earning and saving.

Open a savings account for your child.

Introduce budgeting apps designed for kids.

Avoid Common Money Mistakes

Ignoring finances doesn’t make problems disappear.

Avoid impulse buying, emotional spending, and payday loans.

Always read fine print before signing any financial agreement.

Plan for taxes, insurance, and other yearly expenses.

Review Finances Regularly

Financial planning isn’t one-time.

Set a monthly review session. Check goals, expenses, and investments.

Adjust your plan based on life changes like new jobs or family additions.

Staying updated helps you avoid surprises.

Use Technology to Your Advantage

Many tools can simplify money management.

Try budgeting apps, credit score monitors, and automatic savings platforms.

Set alerts for bill payments to avoid late fees.

Use calculators for loan estimates and retirement planning.

Know When to Get Help

If you’re overwhelmed, ask for help.

Financial advisors, nonprofit credit counselors, and community programs offer guidance.

Look for certified professionals with fiduciary responsibility.

Avoid scams or unqualified “experts.”

Stay Consistent and Patient

Wealth takes time to build.

Celebrate small wins like sticking to a budget or increasing savings.

Review your goals and remind yourself why you started.

Stay motivated by visualizing your financial freedom.

External Links: